If you haven’t already realised just how much it costs to live in Singapore, here’s another reminder: According to a study by Urban Land Institute (ULI), Singapore is now the most expensive place in Asia Pacific when it comes to owning real estate. In terms of absolute prices the median price to own a private property is $1.6M.

While the situation is much better with public housing where Singapore was ranked “most attainable” in ULI’s 2023 Asia Pacific Home Attainability Index, it is still discouraging to hear how expensive it is to attain the Singaporean dream of owning a private property.

But let’s not despair because there are still ways you can attain your status as a private property owner at an affordable price. Here are some tips for you to consider…

1. Forgo Wants, Focus On Needs

The price of a property is a mix of location, size, and amenities that come with it. In the ideal situation, we want it all. You want to be living near the city centre with a few thousand square feet and a swimming pool in your backyard. You know, like a Good Class Bungalow (GCB) at Ridout Road. But of course, the truth is that most of us won't even begin to have that kind of earning power.

Instead, you need to trim all those wants and just focus on your needs so that you can find a property that is more palatable to your budget.

For instance, if you are permanently working from home, is there really a need to stay close to the city centre? Why not consider a place that is away from the hustle and bustle of city life?

If you are not planning to have kids, then do you really need five bedrooms in your home? Two (at most three) bedrooms will suffice.

By trimming away at your wants, you can size up the right property that you’ll need to invest in. This will help you to lower the buying price of the property that you are eyeing.

2. Don’t Skip The Home Budgeting Step To Keep Affordability In Check

One of the pitfalls of home buying is to house hunt without a budget in mind. This gives you a false sense of affordability. Imagine going on a few house tours and falling in love with one of the units that you visited, only to realise that you can’t afford it. And that’s a dangerous headspace to be in if you’re tempted to just push through, even if it doesn’t fit into your budget. This is not the time for FOMO.

That’s why it’s important to start your journey as a homeowner by getting your budget right and solidified. As a general rule of thumb, you don’t want to be spending more than 60% of your monthly income on your monthly mortgage. In fact, even the TDSR states that you can’t do that. If you exceed the 60% threshold, you will have to fork out that down payment in cash or CPF.

A good way to keep your affordability in check is to consult a mortgage broker like Mortgage Master before you go house hunting. A good mortgage broker will present you with comprehensive view of what you can afford so that you know how much you are stretching your finances when purchasing different tiers of property.

3. Engage A Mortgage Broker To Keep Mortgage Costs Affordable

Besides being your guiding compass on affordability, engaging a mortgage broker also comes with added benefits. One of them is their ability to source for the best deals in the market to keep your mortgage costs affordable.

As we enter into a new era of rising interest rates, the impact of high interest rates on the cost of home ownership is huge.

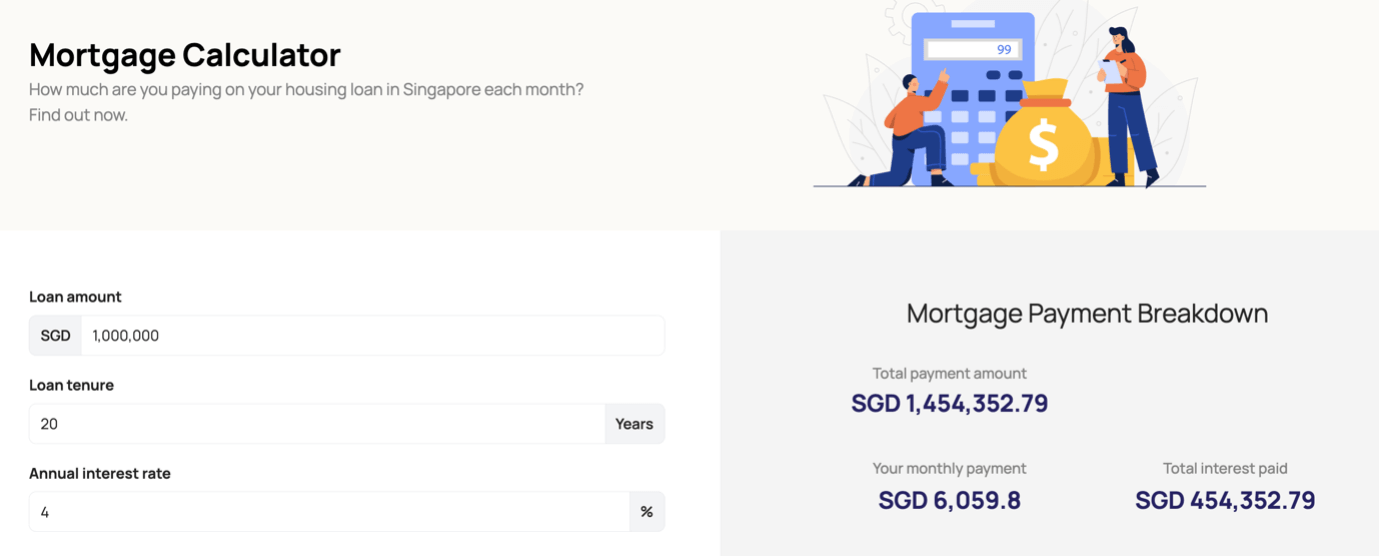

Source: Mortgage Master

Let's assume you currently have a $1M loan for your property over the next 20 years. Your interest rate may have risen as high as 4%, if not higher! At such an interest rate, the total interest you could incur on it will be ~$455,000. That’s almost 45.5% of your curent loan amount!

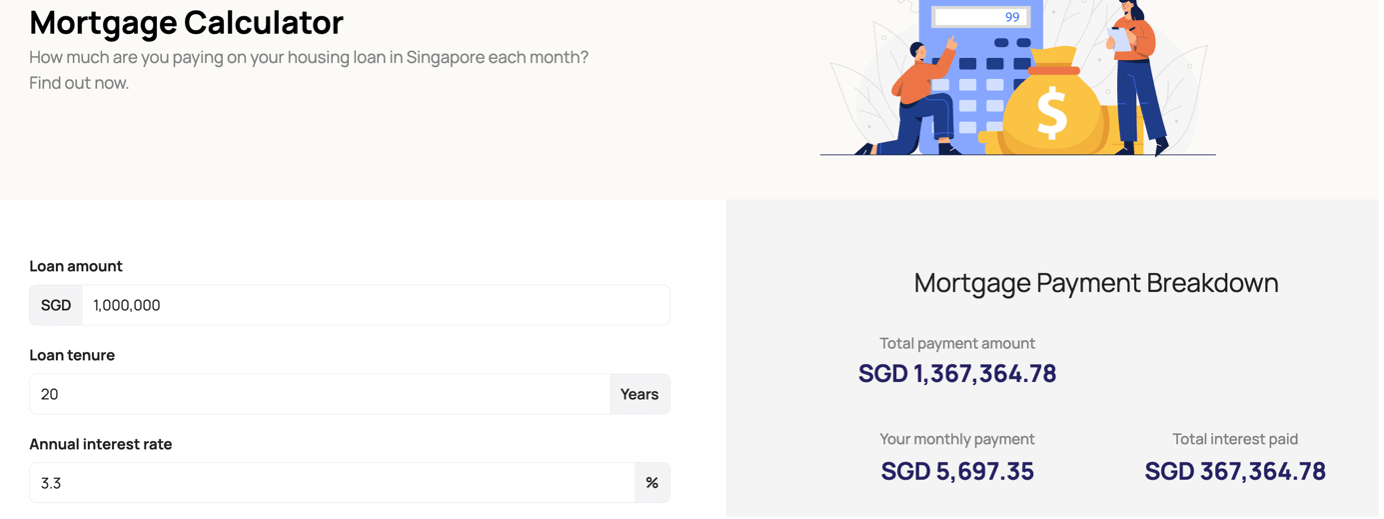

Source: Mortgage Master

If you engaged a mortgage broker, and they recommended you to refinance to a package that's at a 3.3% interest rate, which is one of the lowest existing market rates as of this writing. Doing so will save you a total of almost $90k in interest over the lifetime of your mortgage. And if you think about it, that savings might justify buying that house with the extra bedroom.

4. Don’t Miss Your Refinancing Window

Having a mortgage broker also means having someone to assist you in reminding that your refinancing window is open once again. If you don’t already know, mortgages aren’t cast in stone for life. It’s the same with your mobile phone plans you have with any telco provider.

Typically, your mortgage package has a lock-in period that expires every 2-3 years. When it does, you have the opportunity to switch to a better deal that you can find with a another bank. This is known as refinancing.

Alternatively, the bank that you currently have the mortgage with may offer you a better package to entice you to continue banking with them. This is known as repricing.

Unfortunately, some homeowners miss this opportunity because they didn’t realise that their refinancing window was open. As a homeowner, you’ll want to make sure you work with a mortgage broker so that they can remind you to refinance when the time is right. They can even assist you with the paperwork for your refinancing.

How To Register Your Interest With Mortgage Master

At Mortgage Master, we know the latest home loan packages in the market and can sometimes even offer exclusive interest rate packages that you cannot get directly from the bank.

If you're looking to purchase a new property, or refinance your existing home loan, fill up our enquiry form and our mortgage consultants will follow up with a call.