Homebuying is a bittersweet journey. Sweet because you are making the leap to the next life stage with a place that you can call home. But the bitter part is where you have to go through multiple obstacles before you can complete your homebuying journey. Luckily, there are ways to make your homebuying journey a breeze - if you know where to look.

In this article, we take a more in-depth look into 5 property services that can benefit you when you buy your next home.

1. The New HDB Flat Portal

If you are planning to buy an HDB unit, the most relevant source to consult is definitely HDB itself. For many years, the HDB website wasn’t exactly known for its usability and user-centric design. But things have changed ever since they launched the new HDB flat portal early this year.

Source: HDB

Source: HDB

The HDB flat portal comes with different features that fit in nicely into the user journey of every homebuyer.

-

Financial Calculator

Most people think that searching high and low for your ideal home is the first step in house hunting. Except that it isn’t. The first and most logical step is to determine your budget before you start your house hunting. That’s because having a budget at the back of your mind ensures that your house hunting is targeted.

To determine your budget, you can use the financial calculator provided on the HDB flat portal to figure out how much you can afford for your new home. It also tells you how much you can borrow from HDB to finance your new home.

-

Home Loan Eligibility (HLE) Letter

If you are thinking of borrowing from HDB to pay for your home, you will need to apply for the Home Loan Eligibility (HLE) letter. In the past, you had to search high and low for this link. Now, with the new HDB flat portal, the link is so prominent that you can’t even miss it.

-

HDB Resale Portal

Buying a property isn’t as simple as it sounds. From registering the intent to buy to getting an option-to-purchase (OTP) to getting a property valuation, there are multiple steps involved. Luckily, HDB recognises that and launched the HDB Resale Portal in 2018 to guide home buyers and sellers through the resale journey with a streamlined resale process.

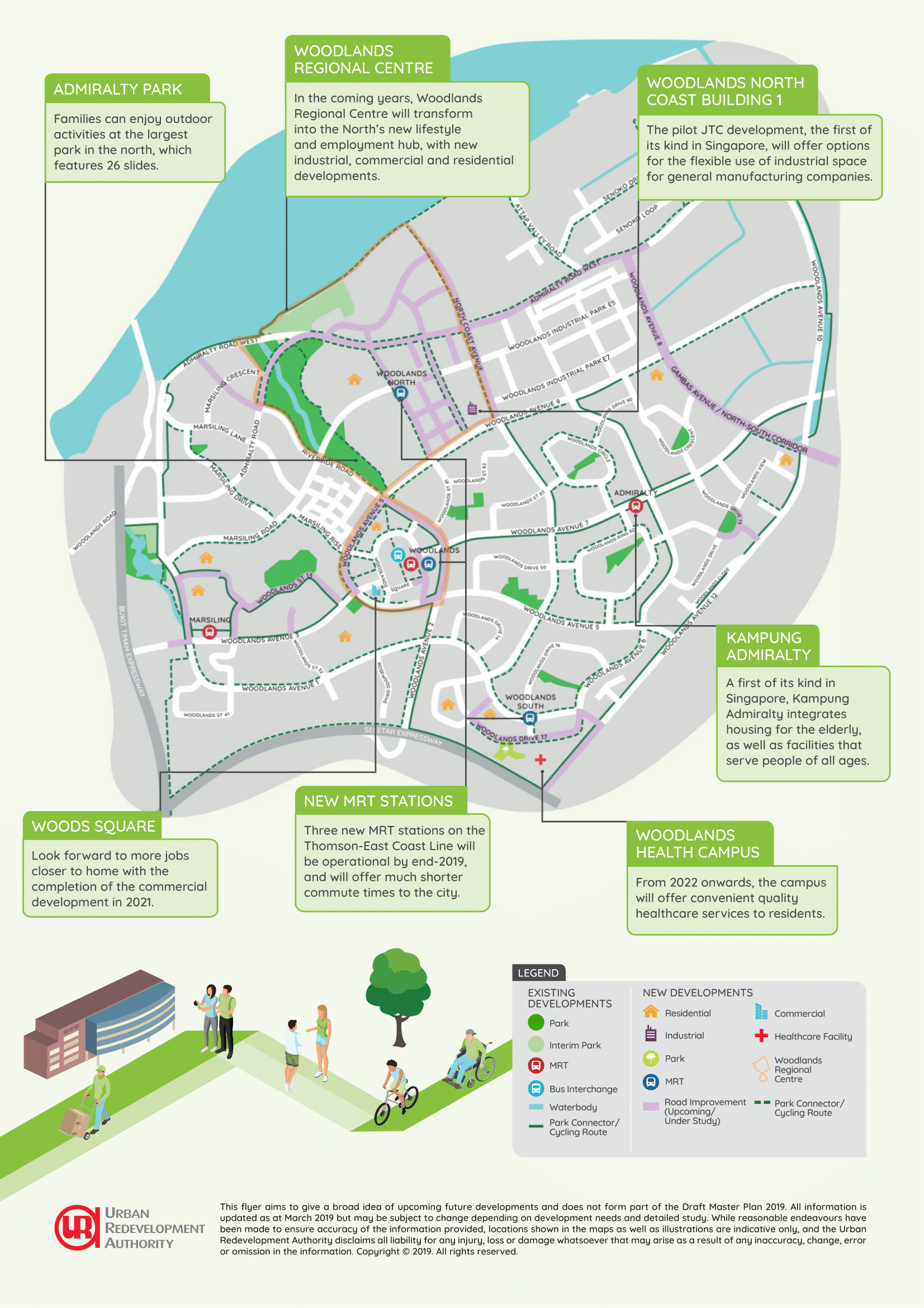

2. URA Master Plan

Buying a property is like looking into the future with a crystal ball. You imagine the kind of amenities and facilities that will be developed in the years to come and hope that you are right. But what if the crystal ball really exists and you don’t have to guess what kind of developments that will happen?

Source: URA

Source: URA

The URA Master Plan is the crystal ball that you are looking for. It is THE statutory land use plan that guides Singapore's development in the medium term over the next 10 to 15 years. Not only will you know what are the key urban transformation projects, you will also be able to find out the kind of highlight developments in different regions in Singapore such as new childcare centres and community spaces.

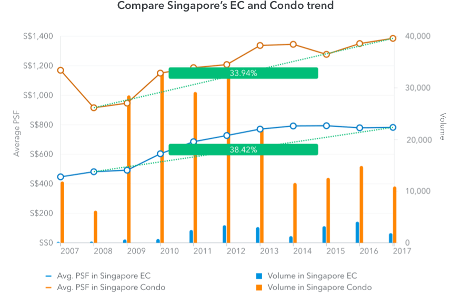

3. Property Analytics – 99.co Researcher, EdgeProp Analytics

Among the different asset classes, property is one of those asset classes that has a very interesting dynamic. Unlike stocks or bonds, information asymmetry is something that property buyers have to live with. Well, that is until recent years where proptech companies released their own property analytics service, like 99.co Researcher and EdgeProp Analytics.

Source: 99.co

Source: 99.co

Source: EdgeProp

Source: EdgeProp

These services not only makes property transaction prices more transparent, but they also make it easy for anyone to do their own analysis. You can compare data across neighbourhoods, districts and development types with your own customisations. It turns you into a real estate pro instantly.

That said, this feature was built for and targeted at property agents to impress their customers (aka you). Therefore, 99.co and EdgeProp do charge some fees for using their service, though some do come with a free trial period.

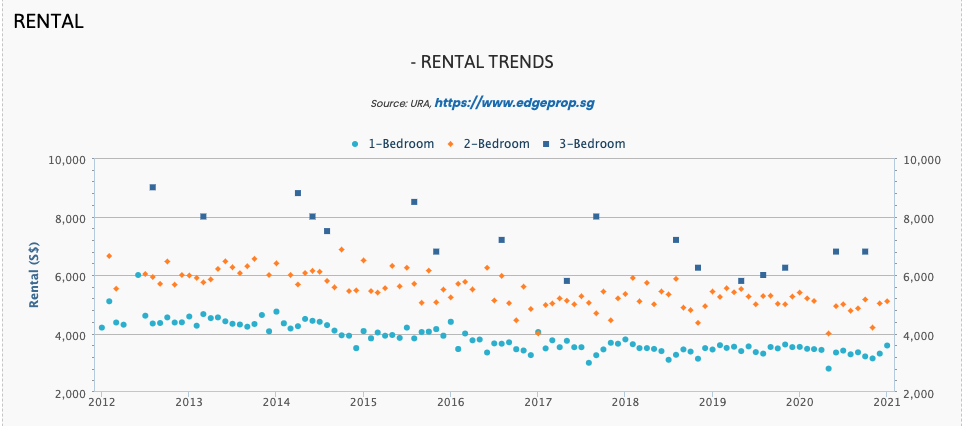

4. Data.gov.sg For Property Price Trend Research

Many of us know that Singapore releases some property price statistics every quarter. But did you know that this data is readily available on the internet? All you need to do is to Google for property price index data.gov.sg and you will find it.

The Private Residential Property Index data posted on data.gov.sg lets you understand how property prices are trending across Singapore. And not just that, it also let you analyse the property price trend by region, district and property type.

For homebuyers, having an overview of the property price trend lets you understand where the property market is heading towards and whether you are over/under paying for your next property.

5. Home Loan Comparison Service

Once you have settled on your ideal home, the next step is to finance your home. For the uninitiated, this is THE key step in your homebuying journey. Do this step right and your biggest financial commitment can be more affordable and less stressful for you. In fact, we believe it is important to START your homebuying journey by getting a HLE and/or an approval-in-principle from a bank. This is an indication of how much you can borrow, so that have a better idea of how much cash you need for the downpayment.

One useful service that you can leverage are mortgage consultants like Mortgage Master. Mortgage consultants help you compare home loan interest rates across different bank loans to ensure you get the best possible deal and avoid paying more than you need on interest payments. Additionally, if you have any doubts or questions about choosing the right home loan package, you also have an experienced and well-trained expert to consult. Best of all, the services of a mortgage consultant are free!

And it doesn’t just end there. Every 2 to 3 years, once you are close to the end of your lock-in period, your home loan might no longer be the best on the market. You have the opportunity to refinance it. A good mortgage consultant will take note of your lock-in period and inform you whether now is an opportune time to refinance to ensure you save money in the long run.

If you are looking for a trusted mortgage broker to serve you, do check us out. At Mortgage Master, we know the latest home loan packages in the market and sometimes can even offer exclusive interest rate packages that you cannot get directly from the bank. If you're looking to purchase a new property, or refinance your existing home loan, fill up our enquiry form and our mortgage consultants will follow up with a call.