Congrats on submitting your bid for your BTO!!!! Finally hell week is over and you can rest

If anything, I would like to formally welcome all of you to …. PHASE 2. Choo choo, all aboard.

But ... what exactly is phase 2?

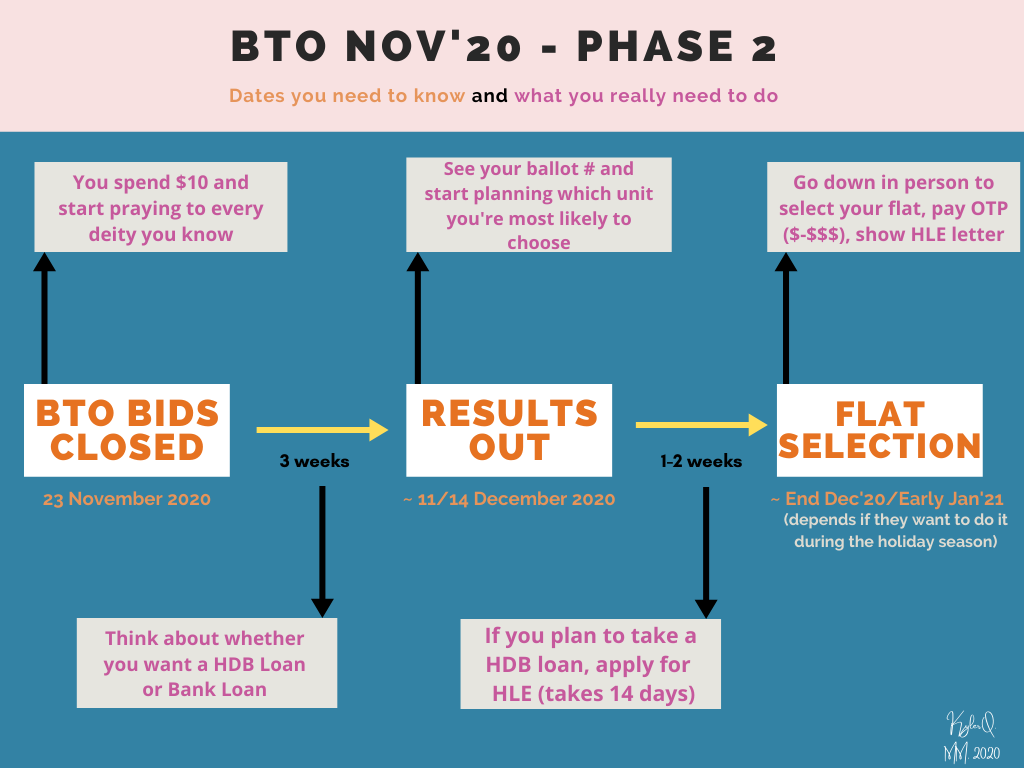

Well, now that you've submitted your ballot for BTO, this is the 3-week wait before the results come out.

To contextualize for BTO Nov'20 bidders, bids closed on the 23 November, so BTO results will most likely be released around 11/14 December.

That shouldn't mean you should just idle around though.

Ideally, these 3 weeks should be used to consider whether you want to take

- an HDB loan,

OR - a bank loan

OR - that you wouldn't even need a loan.

I assume most of you have already gone through articles on HDB vs Bank Loan (you should start if you haven't btw).

If you're kiasu and want to read more, you can read our take where we talk about choosing BOTH HDB AND Bank Loans (ye, we damn trndsttr 🤘 )

But if you just need a recap,

This just covers a brief summary of the essentials between the two types of loans because

- We already have a more detailed infographic on the other article (with more explanation too)

- This isn't the topic we're discussing today

So ... what exactly ARE we discussing today?

In what could be a #8 entry in a WatchMojo 'Top 10 Things You Missed',

you might have overlooked the fact that if you plan to take an HDB loan,

YOU NEED TO DO IT NOW. (i'm not joking)

Let's take a look at the Phase 2 chart again.

If you intend to take an HDB loan, you'll have to present your HLE letter during your flat selection process.

This step is often the most overlooked because most people are more worried about whether they'll get their desired flat, which units are left, if they're gonna get the more-desired higher storey flats, whether it aligns with what the fengshui master said etc ...

Having said that ...

Why HDB Loan Eligibility (HLE) is important NOW

There's really no point explaining what an HLE letter is if you don't feel the importance of it first.

Simply put,

if you intend to take an HDB loan, you have about 1 week left to send in your application

if you intend to take a bank loan, you need to be really sure about it because you can't go back on this decision.

Why?

What happens during your flat selection is that when you select your flat, they'll ask if you need to take a loan.

If you choose the HDB loan, you'll need to show them that you have an HLE letter

- Application for an HLE letter takes bout 2 weeks, and you'll have to show this letter in bout 3 weeks time, hence why it's so important now.

If you choose a bank loan, they'll be like "okurrrrrr but no ragrets k, you can't u-turn your decision", and you only need to take the bank loan when the BTO agreement of lease date gets closer

- This means you have like 3-4 months to decide on which bank loan to take, aka why it's not as important now.

- You can sashay away till the AIP section below

If you choose no loan, then please continue to stay ballin'. Also, feel free to add me on any socials, or contact me @ 9021**** cause ya boi is broke af.

What is an HLE (HDB Loan Eligibility) letter?

2 things to note.

- It's not a typo, it's really called "an" HLE letter, not "a" HLE letter.

- HLE ≠ HDB Loan

An HLE letter is exactly as its name suggests, it only shows your eligibility to what amount you can borrow.

Think of it as something like a consent form.

You remember those excursions in primary/secondary school and you had to forge your parent's signature get your parent/guardian to sign?

The excursion here is getting the loan.

The consent form (HLE letter) is like HDB giving it's signature so that you can go on that excursion.

However, what's different here is that HDB will determine how much you can borrow.

This is actually based on your salary, not the loan-to-value (LTV).

- The LTV is just a representation of the maximum amount you can loan. In most cases, the LTV is actually a cap, because most people are eligible to borrow even more than the 90%.

A more accurate gauge to find out how much you can actually borrow, is to use the Mortgage Servicing Ratio (MSR), where it uses 30% of your total income

Aite calm down, you know I'll always put things in perspective for you.

If the total income is 6k, 30% of that is $1800. That allows you to take a loan of about $395,000.

This eaaaaaaasily clears most of the 4-room flats this BTO (except Bishan .. sorry).

If you're applying with your partner, this means an average income of 3k.

(Now you know why the LTV acts more of a limit?)

This is why most people just look at the LTV, because they can easily get the 90% loan.

That being said, what if your total income is lower?

If the total income is 4k, 30% of that is $1200, which allows a loan of about $260,000.

That doesn't mean you can't afford the same 4-room flats though.

It only means you can loan out lesser. If your CPF has enough money to make a higher downpayment, you can definitely still go for it.

If you want to play around with these values, feel free to do it on the mortgage calculator.

(Just type in any value in the loan, 25 for years, 2.6 for int. rate, and you can see what's the amount you have to pay month.)

(Rmb the amount that shows should be ≤ 30% of your salary)

If your brain just can't anymore with this info, I guess it's only right for you to know this.

Technically, you dont have to show the HLE letter during your flat selection IF,

- you're damn sure you gonna get an HDB loan OR

- you're damn sure you can get a bank loan OR

- you're damn sure you won't need a loan

Think of the HLE as a formality. The friendly HDB people during the flat selection process just want to know that YOU are able to afford the house, that's all, it's just a reassurance at this stage.

The main thing is that you're able to finance your house when you sign at the lease of agreement (this one phase 3).

But to be safe, just apply ok. It's a safety precaution for you and me (mostly me so ya'll won't blame me).

You will have to aply for it eventually anyway, and it has a 6 month validity, which means if you apply now, it'll nicely cover into the lease of agreement period, where you MUST show the HLE if you want an HDB loan.

HLE requirements/eligiblity

Yeap, there's an eligiblity criteria for the eligiblity letter for the real loan. (you can contact HDB to voice your grievances)

For this, it's pretty subjective.

The main things you have to take note of is

- At least 1 buyer is Singaporean

- You don't have a property under your name (local + overseas)

- Your family income doesn't exceed $14k/month.

If you clear these 3, you're most likely to be able to qualify.

Of course, there are way more scenarios that you may fall under, which you can check here.

That being said, now that you know you're eligible to be eligible, all you need is your Singpass and your relevant documents. (This is subjective too cause it depends on your profession).

Approval-In-Principle (AIP)

Ok bank loaners, sashay back, you're not off the hook.

I just needed to address HLE first because the deadline is coming up real soon.

The AIP is basically the bank loan version of the HLE.

Typically, this is how the process goes.

- Gather all the required documents (NRIC, BTO info, OTP, Payslips etc..)

- Go to the bank

- Complain about the queue

- Say you're looking for a housing loan, and hand over your documents.

From here, the bank will calculate and pass you a document (about 2 weeks later), which is the AIP.

This document will basically state that you're allowed to borrow X amount of money from that bank.

It's kinda like a Provisonal Driving License (PDL), you know that unofficial license before you get the real one. Basically the same purpose as the AIP.

You're qualified for it, it's just not the real thing yet.

However, don't kanchiong spider now because you should only be concerned about this as you get closer to the agreement of lease (at least 4 months away).

This is because an AIP will only last you for 30 days.

Ya'll, this one not Hello Kitty @ Macs, there's no need to keep queuing. Just start doing your research maybe bout 2 months before then, have your documents ready, and you're golden.

Oh! One last thing, you see that I underlined "from that bank" above? That's because that AIP (from Bank A for example) will not be applicable for Bank B.

So if you're comparing banks to find the best bank loan, you gotta repeat step 1 - 4 for each bank.

Troublesome hor?

Save yourself that trouble

Finding a weekend just to queue up to submit your documents? Who even does that anymore lol.

Guys and girls,

.

.

.

it's literally our job to compile all the different loans for you, and advise you which loan is best for you.

Look, if you're pretty much settled on a bank loan, or if you just want more information on the current loans that banks are offering, we have all that information.

Plus, we'll even get the AIP for you. So instead of you going down to each bank, we'll just 1x good one get all the AIPs for you.

Oh yeah, and it's free, and it's not some kind of promotion/Christmas deal/scam. (This is how mortgage brokers make money if you're curious)

And it's not just us! All mortgage brokers are free.

It's just that you get cashback if you go with us.

Let's be real, the financial aspect of housing isn't thattttt straightforward. What more, it'll be different for everyone depending on which loan they choose, then if they have any grants/schemes, followed by interest rates (ugh they're the worst), then payment method ...

Furthermore, as of now, you're also clueless about how the results are gonna turn out for you. Will you get your BTO? Or will you have to wait for the next batch? Will you get your desired unit? Or will you have to settle for a less ideal flat?

There's too much uncertainty at this moment.

But regardless what the results are, most of us will probably have to take a loan. So, hopefully, you're at least more clear and certain about what's to come after this article.

Till next time, be good people. And pet your pets for me.