Inflation has been the hot topic recently among investors. One type of asset that has “benefitted” from the tailwind of inflation happens to also be Singaporeans’ favourite type of investment: Property. Indeed, the prices of properties in Singapore has been on an uptrend that seems unstoppable. In March 2022, the price of HDBs sold went up for the 21st consecutive month.

For potential upgraders and those buying your first home, the rising property prices is indeed a worrying sign. It affects your overall ability to buy a home, especially when you will be buying a (more expensive) resale flat. What’s worse is that the property market is less than transparent when it comes to prices, which can put you in a bind when deciding how much to pay for an increasingly expensive HDB resale flat and whether you can afford it at all.

Thus, we designed a much-needed and quick guide to show you a few ways on how you can make a better estimate (and bargain) for the property that you are eyeing.

3 Methods Of Figuring Out How Much An HDB Resale Is Worth

1. The BTO Comparable Method

HDB resale flats are like the evolved version of their Build To Order (BTO) sibling.

After all, many HDB resale flats were once a BTO flat that met its 5-year Minimum Occupation Period (MOP) and got “promoted” to the resale status. Thus, if you want to know how much an HDB resale flat is going to sell for, then the closest comparable will be its BTO sibling.

Source: HDB

Source: HDB

Whenever there is a BTO launch, there will be an accompanying price comparison like this from HDB. HDB does a survey of the resale flat prices in the vicinity and compares it with the BTO that is launched in that month. On average, the price difference between BTO and HDB resale flat is around 20% to 30%.

If you want to gauge the price of the HDB resale flat that you are considering, comparing it with the BTOs that will be launching (or have launched) nearby is a good way to do that.

For example, in February this year, there were 2 BTO launches in Yishun prices for a 4-room flat at the new Yishun Boardwalk ranged from $276,000 to $374,000. A month later, a 4-room flat across the road sold for $495,000, while another sold for $458,000. That's around 30% difference from the highest price of the nearby BTO launch.

2. The Historical Data Comparable Method

While the comparable method with BTOs is a good method, it has its limitations. That’s because BTOs are only launched every quarter. Not just that, there may not be a BTO launch near the HDB resale flat you are considering, especially if you are looking in mature estates. Well, fret not because there’s still data out there that can help you estimate how much to pay for an HDB resale flat.

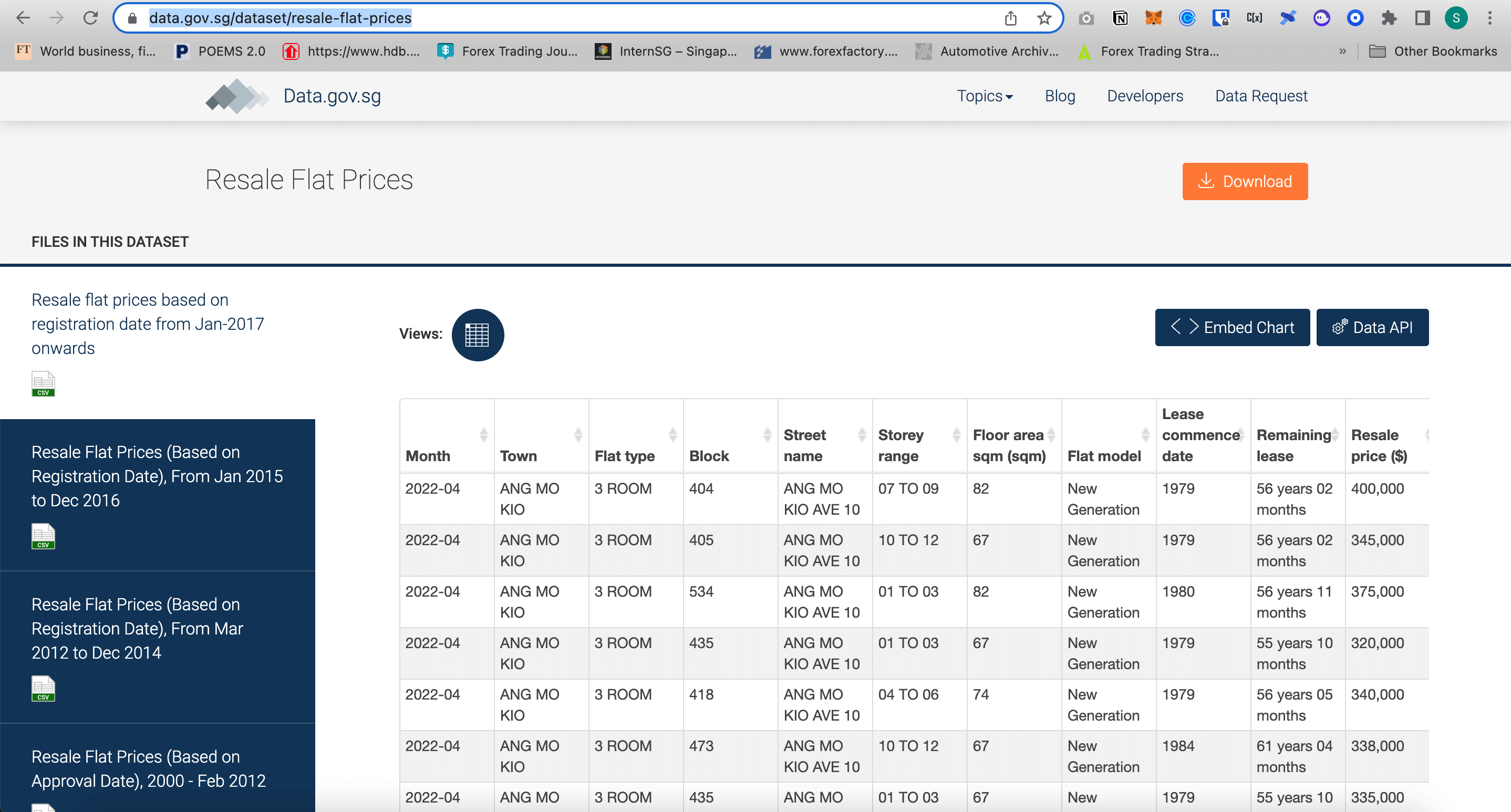

It is an open secret that HDB resale flat prices are updated and accessible by the public for FREE on data.gov.sg. You can actually find all the prices of HDB resale flats sold since the 1990s up to the recent month. The best part is that the data gets updated very frequently so there isn’t much information gap.

Source: Data.gov.sg

The data allows you to filter critical information about the HDB such as flat type, town, storey, floor area and street name. With the data, you can run some quick analysis on the average price of HDB resale transactions that are close to the resale flat that you are eyeing.

If you prefer a more visually appealing method, consider using HDB Map Services. Ultimately, a combination of the two is ideal to get all the data you could ever need.

Of course, there are some limitations to this method because every HDB resale flat is different. Things such as the house condition and potential renovation cost may not be included in this price estimate. But it is a good basis to use as your base price for what is a fair value for the HDB resale flat that you are considering.

3. The Bank Valuation Method

Everyone knows that there are two ways of getting a loan for your home: HDB housing loan vs bank loan. Whenever you get a housing loan, there is always a pre-requisite step to first determine what is the worth of the HDB resale flat that you are planning to buy. This will then allow HDB or the bank to assess whether you are able to afford the property. This step is known as the valuation.

Previously, you could get the HDB resale valuation before applying for the HDB housing loan. However, HDB realised that sellers were abusing this system and marking up their valuation, resulting in higher Cash Over Valuation (COV).

In 2014, this valuation process was moved to the last step of the home buying process. You can only get an HDB valuation once you confirm that you are buying the resale flat at the agreed price with the seller. The HDB valuation process is just to ensure whether you have to pay COV.

But this is a different process when it comes to the bank. There’s no restriction that you need to confirm the HDB resale flat purchase before you get a valuation from the bank. If you are already eyeing an HDB, or a few HDBs, you can enquire with the bank to get the bank’s valuation of the property. This will give you a better gauge of how much the HDB resale flat is worth, at least in the eyes of the bank.

While the bank’s valuation of the property may not be perfect, it can give you a better estimate of what is a fair value for the HDB resale flat. As the buyer, you can then decide how much you want to be paying on top (or below) the fair valuation.

Connect With Mortgage Master To Do A Property Valuation

At Mortgage Master, we are a team of experienced mortgage consultants who have the latest information about home loan packages in the market. Most importantly, we can connect you to the right bankers to help you get the property valuation you need on your property buying journey. This will help you avoid getting “chopped” by the seller, especially in the current seller’s market conditions.

Not just that, as a mortgage broker, we know about the latest home loan packages in the market and sometimes can even offer exclusive interest rate packages that you cannot get directly from the bank. If you're looking to purchase a new property, or refinance your existing home loan, fill up our enquiry form and our mortgage consultants will follow up with a call.