NOTE: The following article was last updated 2 November 2022, for the most recent US Fed update, please read US Fed skips rate hike.

UPDATE 2 November 2022: the Fed has increased rate targets by a further 0.75% this week. The range is currently 3.75% - 4.00% and there is still one more meeting this year.

Today, for the first time in over three years, the US Federal Funds Rate is expected to increase. This also marks the end of an unprecedented low interest environment that was brought on by the onset of the COVID-19 pandemic in the United States in 2020. Since there is a historical correlation of the Fed Funds Rate to local interest rate benchmarks like SORA, the Singapore Overnight Rate Average, this will have significant repurcussions on home loans in Singapore.

What does the US Fed interest rate have to do with SORA?

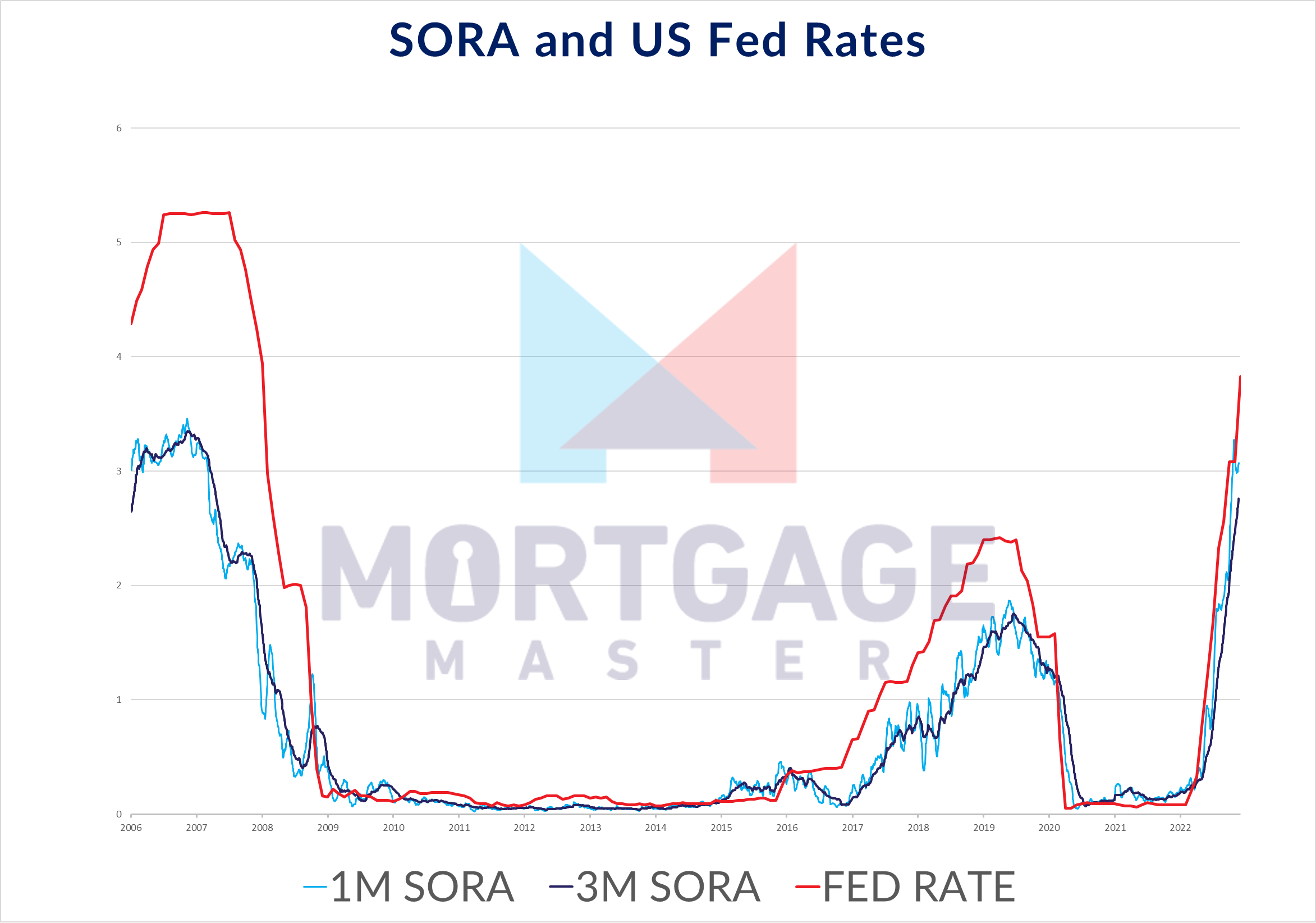

Back in 2020, we demonstrated how the Fed's interest rate movements are closely linked to the Singapore Interbank Offer Rate or SIBOR. Despite SIBOR being phased out by the end of 2024 and all new home loans in Singapore being pegged to another interest rate benchmark, SORA, we can see from the chart below that SORA also is affected by an interest rate hike in the US Fed Funds Rate.

(correct as of 2 November 2022)

(correct as of 2 November 2022)

In Singapore, new floating rate home loans are pegged to SORA, either to 1M Compounded SORA or 3M Compounded SORA. These are rates that are published by the Monetary Authority of Singapore daily. As you can see from the graph above, 1M Compounded SORA is more volatile than 3M Compounded SORA, which is why 3M SORA packages are what you will find offered by most banks in Singapore.

3M SORA follows a very similar trajectory to the US Fed Funds Rate over the past 8 years. From 2017 onwards, we can see that SORA moves in tandem with the US Fed Funds Rate, rising steadily and peaking at the same time in the first half of 2019, before falling, and then crashing in the following year.

Why does SORA follow the US Fed interest rate so closely?

SORA is known as a "backward"-looking interest rate, which means it reacts to interest rate movements in Singapore. However, since changes to the US Fed Funds Rate has global repercussions, SORA is expected to react accordingly. You will not see SORA prematurely rising too out of step with the US Fed Funds Rate.

This is in contrast to SIBOR, which is a "forward"-looking interest rate, determined by the banks. That means it tries to predict interest rate movements, rising ahead of an increase in interest rates, and staying the course despite a drop in interest rates.

A chief example of how SIBOR over-anticipated a rise in interest rates was in 2015, when it prematurely shot up from below 0.5% to hit 1.0% even before the Fed Funds Rate increased at the end of the year.

What does a change in the US Fed interest rate mean for SORA in 2022?

What this means in 2022 is that we can expect SORA to rise steadily, but only in step with changes in the US Federal Funds Rate.

The Federal Reserve in the United States is governed by the Federal Open Market Committee, which meets several times a year. At each of these meetings, they have the option to vote to change the target range of the Federal Funds Rate. Of course, over the past two years, because of COVID-19, they have reduced the target range to its lowest of 0.00% to 0.25%.

In the last meeting of the Federal Open Market Committee, or FOMC, at the end of January this year, however, they noted that "With (U.S.) inflation well above 2 percent and a strong labor market, the Committee expects it will soon be appropriate to raise the target range for the federal funds rate." This is a clear indicator that the next time they meet, we can expect a rate hike.

That next meeting happens today, 15 March. What is notable is that the FOMC will be expected to meet 6 other times this year, which means that we could see a maximum of 6 more increases by the end of this year!

However, most analysts think that because of the ongoing war in Ukraine, not to mention with the pandemic still not showing any signs of slowing down, a more gradual interest rate hike would be appropriate until things are more certain.

What is undeniable however, is that the time of low interest rates are over, for now.

What does this mean for your home loan in Singapore?

If you are currently on a variable rate, either pegged to SIBOR or SORA, you can expect your monthly repayments to increase in the coming years. Typically in a rising interest rate environment, a safer bet would be to secure a fixed rate home loan. However, banks have already taken steps to increase fixed rate home loan prices, or offer fixed rates for a shorter period, or both.

This means that homeowners don't have that many options to avoid paying more on their monthly repayments over the next two to three years. However, it is also important to ensure that you make the decision that is right for your current financial situation. A mortgage consultant like Mortgage Master can help you find and lock in home loan packages with the best interest rates, while advising you on the pros and cons of your options.

At Mortgage Master, we know the latest home loan packages in the market and sometimes can even offer exclusive interest rate packages that you cannot get directly from the bank. If you're looking to purchase a new property, or refinance your existing home loan, fill up our enquiry form and our mortgage consultants will follow up with a call.