When it comes to property investing, having a roadmap of the kind of infrastructure and amenities that are planned in the next decade is always handy. The Singapore government also recognises that and thus releases the URA Master Plan every 5 years, not only to guide Singapore's development in the medium term, but also to help Singaporeans make better property decisions.

Find out how you can use the URA Master Plan to your advantage as a homebuyer.

Besides the URA Master Plan, the government also recently released a new medium term plan that has the potential to impact Singapore’s property landscape: Singapore Green Plan 2030.

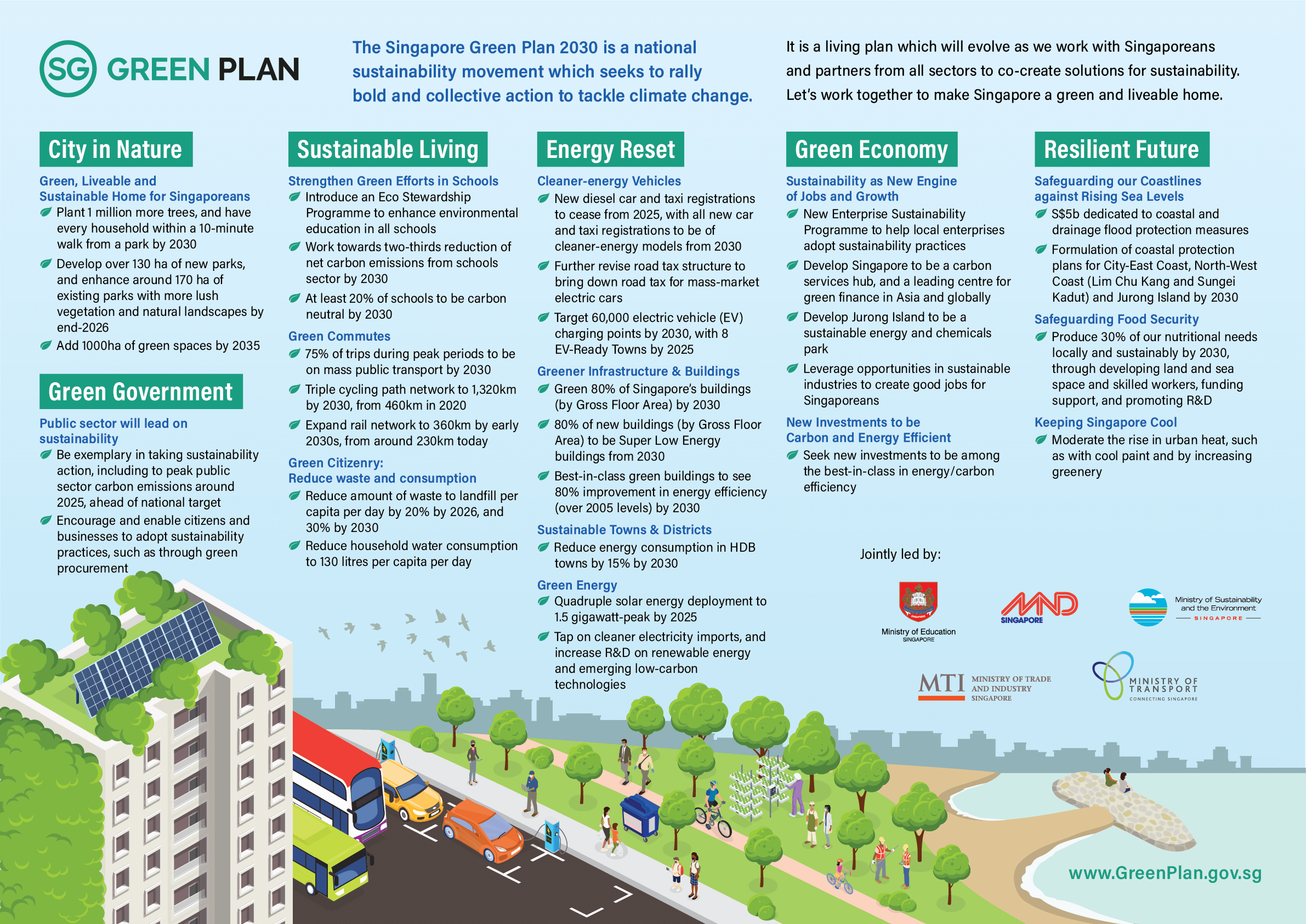

Overview Of The Singapore Green Plan 2030

The Singapore Green Plan 2030 was released in February 2021 as a joint initiative by five different ministries (MOE, MND, MTI, MSE and MOT) to help chart Singapore’s path as a green and sustainable nation. The infographic above shows the full summary of the different pillars of the Singapore Green Plan 2030 and the details of each pillar.

But more importantly, how does Singapore Green Plan 2030 impact your plans as an upcoming or existing homeowner? In this article, we break down some of the potential impact that the Singapore Green Plan 2030 will have on Singapore’s property landscape and how it will impact you as a homeowner.

3 Key Pillars In The Singapore Green Plan 2030 And How It Will Impact Singapore’s Property Landscape

City In Nature (Pillar 1) – Lowering The Premium For Properties Near Green Spaces

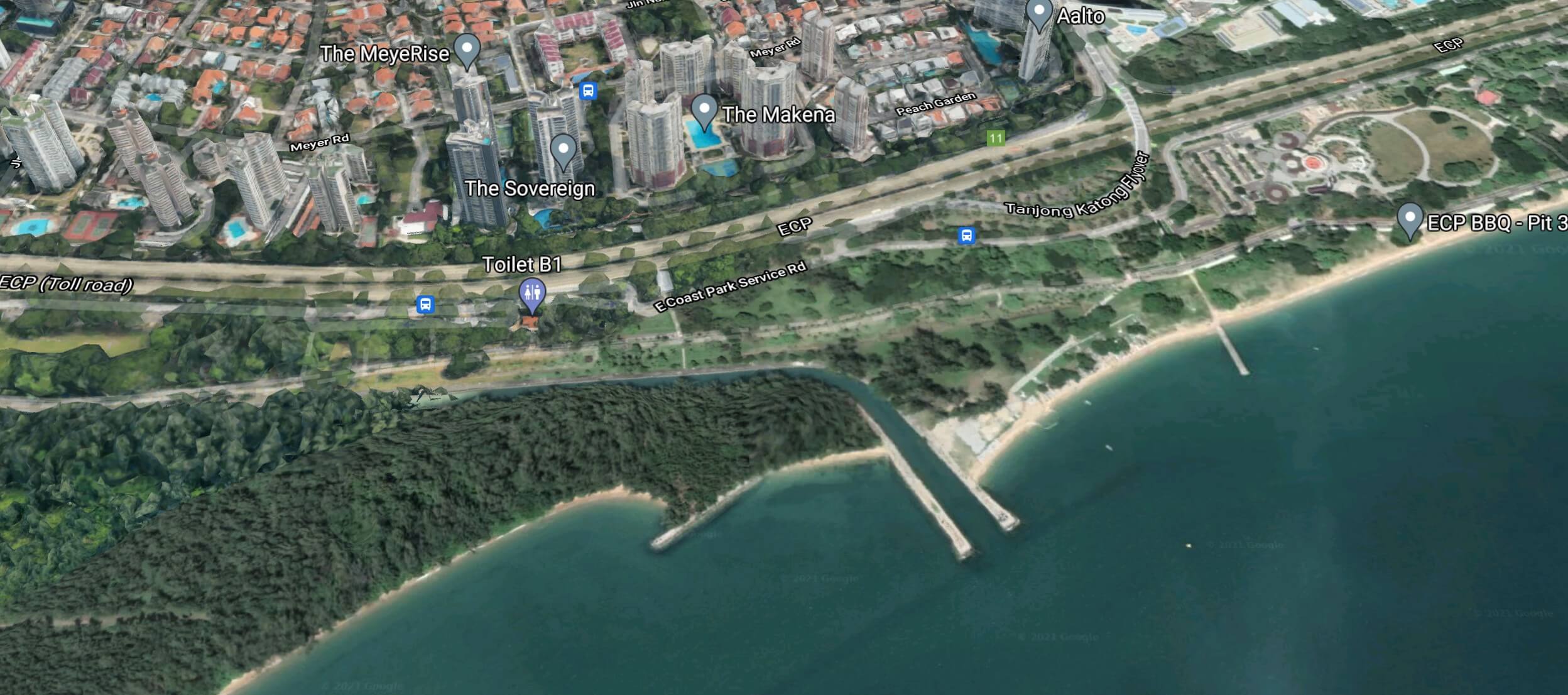

Source: Google Maps

To create green, liveable and sustainable homes for Singaporeans, a key pillar of the Singapore Green Plan 2030 is to develop more green spaces in Singapore.

The Singapore Green Plan 2030 has put a quantitative target to “develop 130 hectares (ha) of new parks, and enhance around 170ha of existing parks with more lush vegetation and natural landscapes”. In addition, there will be 1,000ha of green spaces set aside with 200ha for new nature parks such as the Round Island Route and Coast-to-Coast trail. There are also plans to add more skyrise greenery with green walls and roofs.

Properties that are near green spaces (e.g. those near Bukit Timah Nature Reserve, East Coast Park) have so far enjoyed an elevated status, given the scarcity of green spaces in Singapore. With more green spaces expected to come online, homebuyers can expect the premium gap for living near green spaces to be lowered and make living near nature more affordable.

Sustainable Living (Pillar 3) – Investing Heavily Into Public Transport

Pillar 3 of the Singapore Green Plan 2030 is about the way we live. The plan is to encourage those living on this small city state to pick up more sustainable living habits. One of the key elements of sustainable living is to encourage greater use of public transport so that Singapore’s carbon footprint can be reduced.

In order to make public transport the mainstream mode of transportation, Singapore plans to continue investing heavily in public transport. The plan is to make public transport coverage in Singapore as good as those in metropolitan cities like New York and London by 2030. Some of the investments in public transport that have been sanctioned so far are the Thomson-East Coast Line, Cross-Island Line and Jurong Region Line.

Besides green spaces, there is also a premium that homebuyers pay for living close to MRT stations. That’s because staying close to MRT stations offer greater convenience, both for daily living as well as commuting to and from work. Living within 500m of an MRT station creates a 10% to 15% premium on average over other properties.

With more MRT stations coming online as Singapore continues to invest in public transport, more homeowners will get to benefit from the “MRT premium”.

Green Economy (Pillar 4) – Sustainable Financing For Developers, Homeowners

Another pillar of the Singapore Green Plan 2030 is to pivot towards a greener and more sustainable economy. Not only does Singapore want to be a leading carbon trading and services hub, we also want to be a leading centre for Green Finance in Asia and globally.

In fact, the Monetary Authority of Singapore (MAS) is already pushing for Singapore to become a hub for green/sustainable financing for ASEAN and Asia. According to MAS, sustainable financing, is the practice of integrating environmental, social and governance (ESG) criteria into financial services.

Green Financing For Real Estate Developers

So far, the big three banks in Singapore (DBS, OCBC and UOB) have already started to dipped their toes into the green loan market. For instance, UOB agreed to its first green loan of $130m to Boustead Projects to refinance Alice@Mediapolis, a smart eco-sustainable business park development. DBS also has its fair share of green loan customers with Sembcorp Marine being one of them. Likewise, OCBC has agreed to a couple of green loans and businesses, including a $200m green revolving credit facility for Mapletree Logistics Trust.

Unlike the usual bank loan, green loans allow the borrowing company to enjoy lower interest rate if pre-determined ESG targets are met. Some ESG targets include running the facility with renewable energy up to a certain percentage and reduction of carbon footprint.

For the retail market, the shift into green financing could potentially lower the cost of development for developers. This will trickle down to lower cost of ownership for homeowners.

Green Financing For Homeowners

It is not just developers who will be able to enjoy the green financing. Banks are also pushing for green loans for homeowners as well to encourage homeowners to do your part in being Singapore’s push for a greener economy.

For instance, HSBC is offering a special Home Loan Green Mortgage Promotion with one of the lowest rates in the market today! If your property has a valid Green Mark GoldPLUS or above award, do speak to us to find out how you can save on your monthly home loan repayments in the long term.

For homeowners, the Singapore Green Plan 2030 is providing real financial incentives for you to be inculcate more sustainable practices in your home to help you reduce the cost of homeownership.

At Mortgage Master, we know the latest home loan packages in the market and sometimes can even offer exclusive interest rate packages that you cannot get directly from the bank. If you're looking to purchase a new property, or refinance your existing home loan, fill up our enquiry form and our mortgage consultants will follow up with a call.