The biggest purchase in people’s life is a home, and a mortgage is the biggest loan you will ever take. Choosing the right mortgage package is extremely important, but so is getting it at the right time. By simply making good decisions based on the economy today, a $300,000 loan could easily save you $30,000 throughout your loan tenure. Ignore the economy today, and your loan could cost you $30,000 more. Imagine how much more you could be saving (OR losing!) if your loan amount was even bigger!

As the global economy changes, so do interest rates around the world. These changes are generally cyclical. During an economic boom, interest rates typically rise to counter inflation. On the other hand, a recession will cause interest rates to fall.

Here are the 3 things you need to know about why the economy today makes floating rate home-loan packages ideal.

#1 The US Fed rate has dropped. What does this mean for me?

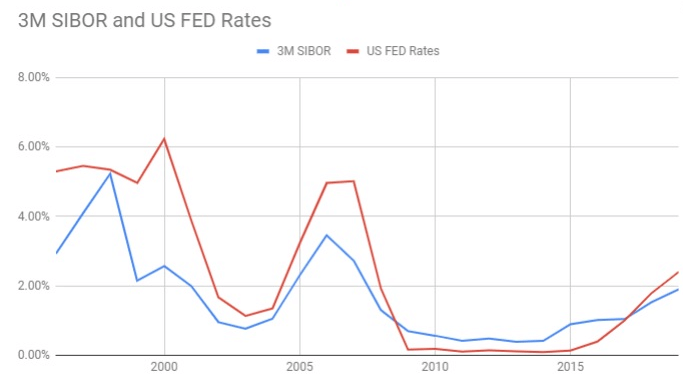

Global interest rates are very closely linked to the US economy. When interest rates in the US are cut, this means that interest rates in Singapore will drop as well. In the past 20 years, this relationship has been pretty consistent, as the graph demonstrates.

As you can see, a Fed rate increase will cause SIBOR to increase, and a reduction in the Fed rate will cause SIBOR to drop. With the latest Fed Rate cuts, we predict SIBOR will drop another 0.25% or more by the end of the year.

What does this mean for you? By taking a SIBOR-based floating rate package, you can expect your mortgage interest rates to drop in the near future when SIBOR falls.

#2 Why not take a fixed rate?

Fixed rates, as you can guess, are… fixed. In theory, this would be great to avoid volatile interest rates.

However, in Singapore, you will unfortunately not be able to get a fixed rate for life. Instead, fixed rate packages are only fixed for the first two or three years. After that period, they convert to a floating rate.

For example, imagine the following represents the best fixed rates at this moment:

Two years fixed at 1.75%

3M SIBOR + 0.75% thereafter

Now taking a fixed rate may give you peace of mind during a rising interest rate environment. If interest rates fall, however, your rate will still stay fixed at 1.75%. In the meantime, all your friends who took floating rate packages may be paying a lot less than 1.75% interest on their mortgage.

There are signs that an impending recession may be around the corner with interest rates already trending down. The Singaporean kiasu (fear of losing out) gene in me refuses to take fixed rates because I could lose out on lower interest rates by the second year or even earlier.

However, I know there are kiasi (super conservative) home owners, out there. For these, fixed rate packages are still available and of course, I consider it my duty to find you the lowest one.

Feel free to WhatsApp us, call us, or fill up our contact form, should you have any burning questions about fixed rates that need to be answered.

#3 Why not wait till the floating rate drops before I take it up?

Most times in life, the “wait and see” method does reap better returns and provide less risk.

But there are also many times it does not. When it comes to home loans, the “wait and see” method is often not rewarded.

Let me take you on a journey through time to illustrate what I mean.

The year is 2015.

3M SIBOR is 0.8% and the market rates are around 1.55%

The best package provided by the banks are

3M SIBOR + 0.75% first three years

3M SIBOR + 1.25% thereafter

Back to reality (4 March 2020)

3M SIBOR is 1.58% and the best rates (for now!) are something like this

3M SIBOR + 0.25% first three years

3M SIBOR + 0.75% thereafter

With the above comparisons you can see that when floating rates are low, banks also stop offering the kind of spreads you see today (i.e. from +0.25% to +0.75%).

That is why we recommend you take a 3M SIBOR package now. In two years, when SIBOR returns to 2015 levels (remember, interest rates are cyclical!), you will have no need to refinance as your current rate (with lower spreads) will be better than what the market offers.

We are here to help you master mortgage!

At Mortgage Master, we understand that everyone has different risk appetites and also different levels of awareness when it comes to mortgage jargon.

Best of all, our service and advice is free!

At Mortgage Master, our consultants have many years of experience in the industry and are happy to answer all your questions about home loans in Singapore. We will even be able to advise you on the best home loan in Singapore based on your financial situation. So drop us a WhatsApp message and let us help you confidently make this important decision in your life.