While investors have been seeing the volatiity of the stock and crypto market valuations over the past year, the property market valuation hasn’t seen the same kind of correction yet. While there are signs of property valuation moderating, it appears that these valuations are still going to continue to stay high for some time, at least for now.

The big question is: Why are property valuations not coming down when there’s an impending recession?

1. Singaporeans Can Still Afford The Higher Property Valuation

Like any type of asset, property valuation is dependent on the invisible hand of the market to balance existing demand and supply. If there’s good demand for property, then there’s really no reason for property prices to come down. In fact, that’s exactly what’s happening in Singapore’s property market.

Introduced a couple of years back, the Total Debt Servicing Ratio (TDSR) has been helping many households in Singapore maintain a sustainable debt level. This has helped buyers avoid over-leveraging and overextending their credit for their property purchase. As such, the buyers who are currently in the market are all serious and legitimate buyers with good credit record. This allows them to get access to capital to purchase their next home by taking out a maximum Loan To Value (LTV) mortgage from the banks.

2. Condo Buyers Are Downgrading And Willing To Pay A Premium

The past decade of easy credit has prompted a significant number of homebuyers to jump into the condo market. But with the impending recession, job layoffs, and rising interest rates coming, homeowners are starting to relook into their considerations; is now the best time to be financing a costly condominium?

Instead of holding on to a $1m one-bedroom condo, some homeowners are making the move to downgrade back to a HDB resale flat. With the $1m, they can easily buy a 5-room flat or bigger in the public housing market. As such, condo owners who are making the downgrade have the capital available to them to pay a premium to existing asking prices of sellers, causing home prices to be jacked up because of higher demand.

This sentiment is also echoed by National Development (MND) Minister Desmond Lee, who said this last year, “Broadly, when they sell their private properties and move into the HDB resale market, generally... they can pay more and higher cash over valuation”. This is also backed by numbers from MND where number of private property owners buying HDB resale flats has doubled in the last two years, compared with the previous two years.

3. Rental Rate Is At All-Time High

According to the latest data released by Urban Redevelopment Authority (URA) and HDB, rental rates for both HDB and private housing climbed by 8.6% in Q3 2022. The number of rental transactions are also climbing with transactions for private homes going up by double digit percentage points. This is very indicative of the strong demand in the rental market, especially since rising property valuation is making potential homeowners rethink whether now is the right time to commit to such a big ticket purchase.

With an all-time high rental rate, existing homeowners have an additional source to cope with rising interest rates. They may even factor in this extra rental income into their budget calculation when deciding which property to buy. This helps some homeowners better justify why they don’t mind paying for a higher property valuation today and move in earlier since they can partially offset it by renting out one or two rooms when the home is ready.

4. Housing Loans Are Still Affordable, For Now

Higher interest rates are a potential source of property devaluation. As interest rates go up, this creates a ripple effect on interest rates of existing bank loans. When this happens, some existing owners might be forced to let go of their property at an undesirable price. But at the moment, interest payment on housing loans is still affordable for most households.

For instance, those who are on the HDB housing loan will still enjoy a 2.6% interest rate. That said, interest rates are definitely rising fast. Interest rates for HDB and private properties have gone above 3% territory for fixed interest rate bank loan packages. Most floating interest rate packages are currently above 4%!

This is unlikely to cause a domino effect to cause a large oversupply of unwanted homes into the market. Families with a combined household income of at least $5,000 will still be able to manage the increasing mortgage repayment, for now.

What Can You Do If You Are Buying A Property Now?

For any of our readers who’s thinking about buying a property in this market, what can you do to keep the cost of home ownership affordable? Keeping your hidden property costs low.

One key driver for hidden property costs is the amount of interest you are paying on your bank loan.

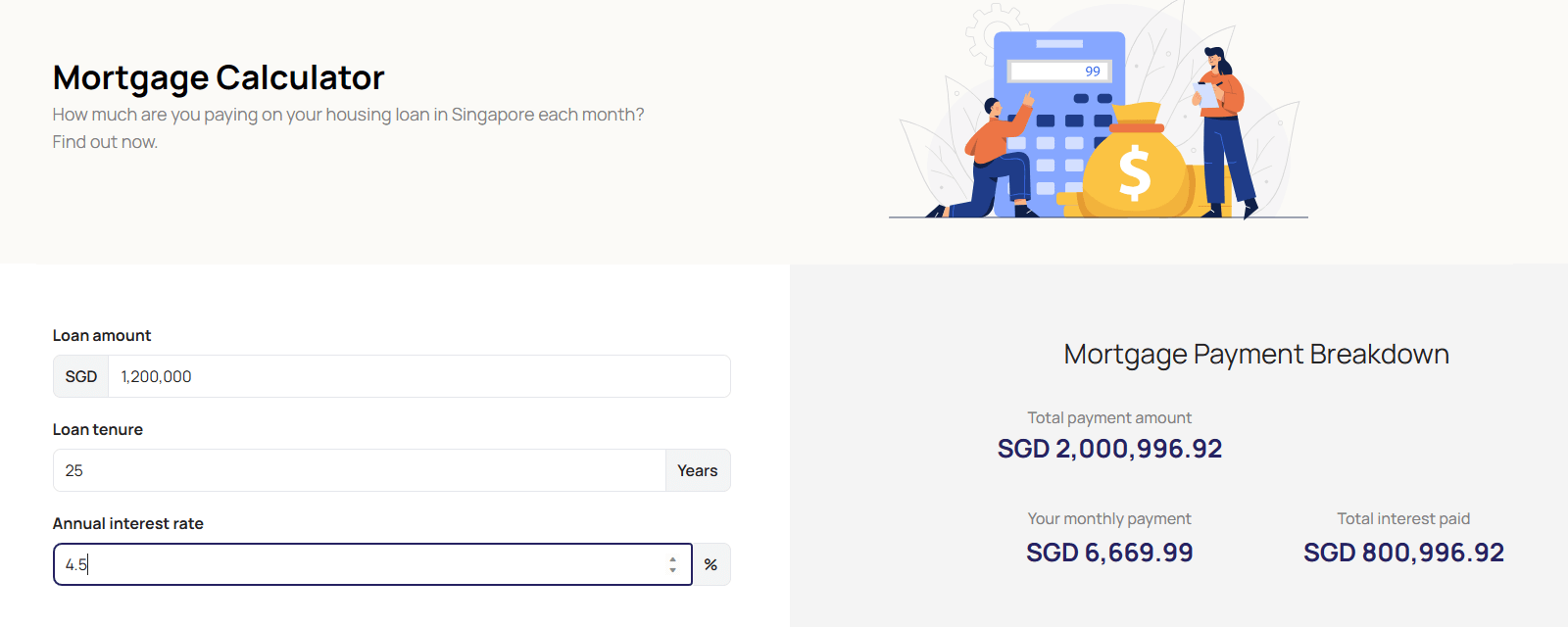

Let's assume you were to take out a bank loan of $1.2m to purchase a property for the next 25 years - the bank offers you a floating rate package at an annual interest rate of 4.5%. Did you know the total interest that you might end up paying will be a whopping $800,997? That’s almost 67% of the loan amount that you are borrowing from the bank.

Source: Mortgage Master Calculator

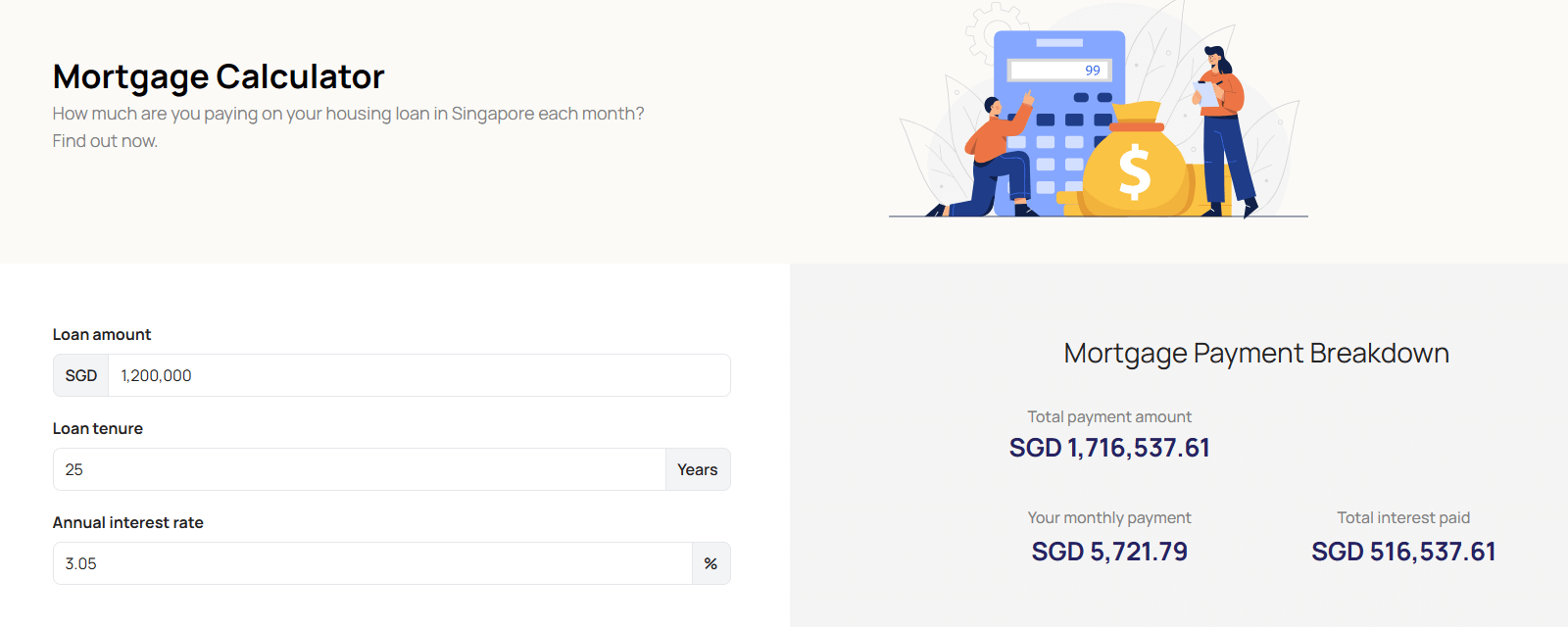

This is definitely something that you can save on. For example, if you found a home loan package that starts at 3.05%, you can save more than $284,000 on interest paid to the bank. That’s a 35% discount from what you would have paid the bank in interest.

Source: Mortgage Master Calculator

While some of the factors that we mentioned above are beyond your control, you are in the driver seat when you’ve got to manage how much you’re paying as interest rate.

One good way to do so is to engage a reliable mortgage consultant to help you get the best deal. Not just that, a mortgage consultant can also advice you on how much you are able to afford for your property based on current interest rates. This will help you to avoid overcommitting or over-leveraging your finances for your next property.

At Mortgage Master, we know the latest home loan packages in the market and sometimes can even offer exclusive interest rate packages that you cannot get directly from the bank. If you're looking to purchase a new property, or refinance your existing home loan, fill up our enquiry form and our mortgage consultants will follow up with a call.