Additional Buyers Stamp Duty (ABSD) is going up (again). While the headline is mostly about residential buyers, there is another group that is indirectly impacted by the new ABSD hikes: Developers.

After all, developers are the suppliers of new residential homes to buyers. If demand from residential buyers dampens, developers will inadvertently suffer as well.

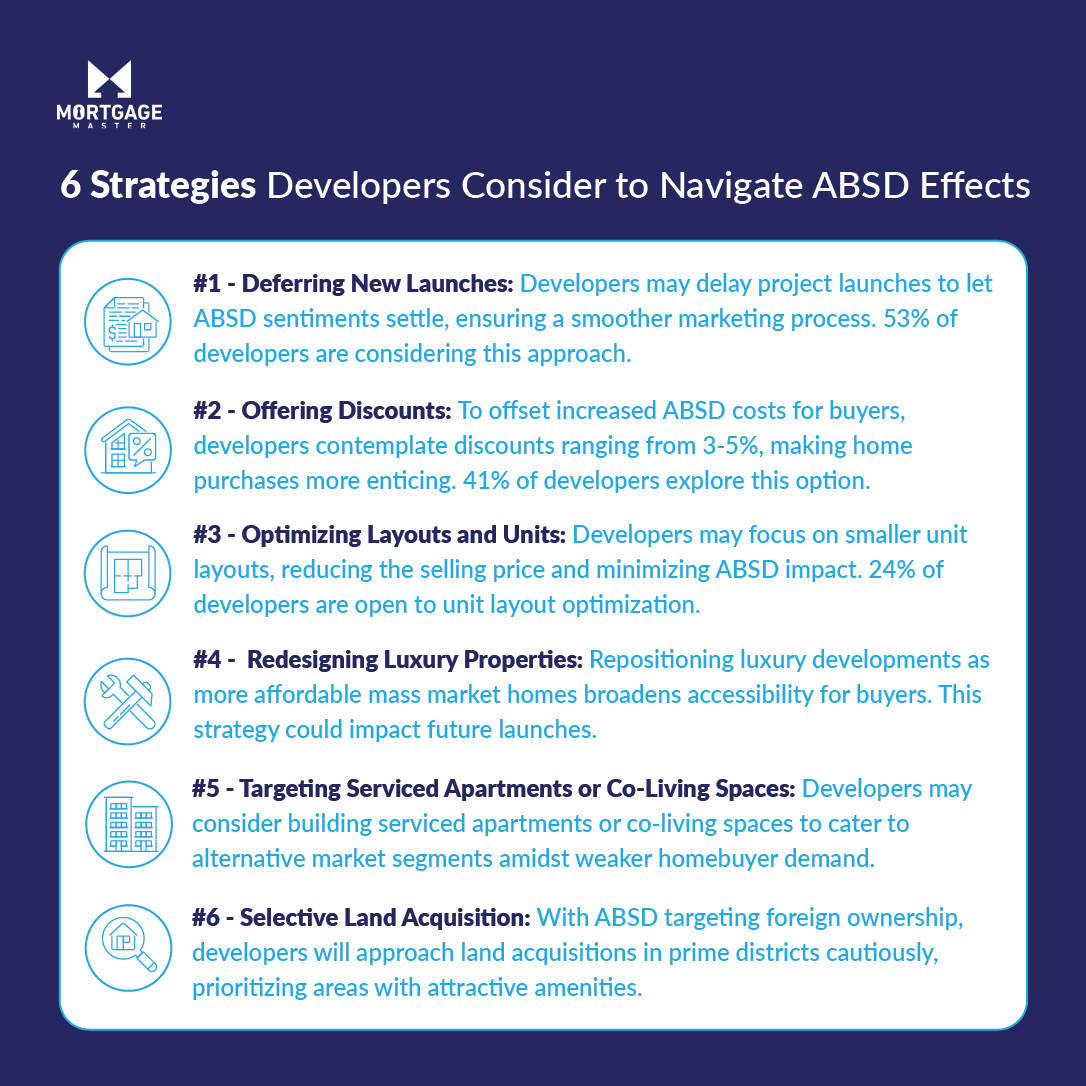

In a recent survey conducted by NUS Real Estate, developers were asked about some actions that they are considering to take in light of higher ABSD charges. In this article, we dive into each of these possible actions and why developers are considering them.

1. Deferment Of New Launches

Sometimes, timing plays a part when it comes to selling a new launch. This is especially if the developer had plans to launch right after the ABSD hike. Naturally, sentiments on the ground will be heightened and potential buyers will be speculating and reconsidering their options. That’s why deferring new launches is the top choice among developers who were polled.

Even if developers were still confident about the new launch that they were offering, it seems like they rather let the news of ABSD die down before they continue work. Once it’s no longer at the back of people’s minds, developers would have a much easier time marketing the project. And that’s based on a survey where 53% of developers are genuinely thinking about deferring new launches.

2. Offering Discounts Between 3-5% To Offset Increase In ABSD

When ABSD goes up, the dollar amount that a potential homebuyer has to fork out will rise.

One way for the developer to entice buyers to stay on course and complete the purchase is to offer some discount in order to offset the increase in ABSD. And that’s exactly what some developers are thinking about doing. While a 3-5% discount may not sound a lot, it is at least a $30k to $50k offset from your buying price. The dollar amount savings is substantial.

Based on the same survey, 41% of developers who responded are thinking about such discounts, although the amount was never disclosed.

3. Smaller Units To Optimize Layouts And Number Of Sellable Units

While the ABSD rate is a percentage of the selling price, it hits the hardest when a buyer is purchasing a large quantum unit. That’s because 20% ABSD for a $1m unit is $200k whereas 20% of a $3m unit will be $600k. This makes units that are of a higher quantum to be much less attractive compared to smaller units.

One way developers can try to reduce the selling price of the development is to optimize for smaller layouts. This will help to “ease” the ABSD charges since the selling price is of a lower quantum. A lower quantum also helps with demand since the pool of homebuyers shrinks as the selling price increases.

Based on the survey, 24% of developers who responded may consider such unit layout optimization for future developments.

4. Redesign Luxury Property Offerings Into Mass Market Homes

Besides optimizing for smaller unit layouts, developers may also think about the branding of the project. Luxury developments are attractive, but the price point may be out of reach to the mass market homebuyers. Therefore, by redesigning luxury property developments and opting for a mass market option, it helps to make homes more affordable.

This will probably impact new launches coming in the next few years. For launches that are launching this year, it might be too late to undergo such a major transformation within such a short time.

5. Targeting Serviced Apartments Or Co-Living Spaces Instead

If demand is not strong among homebuyers, then how about targeting a different segment instead? Well, that’s another option for developers.

Rather than develop and sell, a developer may consider lodging a change of land use to build serviced apartments or co-living apartments. With the hot rental market, serviced apartments and co-living apartments are back in trend again. That said, it is anyone’s guess whether the long term viability of building and maintaining serviced apartments or co-living spaces might be worth the effort.

6. Being Selective In Land Acquisition In Prime Districts

Properties in prime districts have been in high demand among foreign buyers. However, with the new ABSD specifically targeting foreign ownership, such demand may dry up. Developers that are planning to do an enbloc or bid for government land in prime districts will need to keep this in mind.

Developers will likely adopt a more cautious approach in their next land bank replenishment exercise. They will likely continue the old and trusted approach of targeting areas with good amenities to ensure that interest in new launches remain strong.

Managing Your Cost Of Home Ownership

As a soon-to-be homeowner, the shift in strategy from developers will also change how we think about our next home purchase in years to come. For now, we can only speculate about how this will impact our home buying decision.

As a financially savvy homeowner, the most reliable thing you can do is to manage your cost of home ownership. Which could be as simple as engaging a mortgage consultant to help you out with these complicated situations.

With a trusted mortgage broker like Mortgage Master, we keep you updated with the latest home loan packages in the market and can sometimes bring you exclusive interest rate packages that you cannot get directly from the bank.

If you're looking to purchase a new property, or refinance your existing home loan, fill up our enquiry form and our mortgage consultants will follow up with a call.