Last week, in Parliament on the 4th of April, questions were asked about the rising interest rates and how it would affect mortgages in Singapore. In his response, Minister of State Alvin Tan revealed that the median Total Debt Servicing Ratio (TDSR) in Singapore is currently at 43%, and therefore the overall debt servicing ability of households is "manageable".

But what does Total Debt Servicing Ratio mean in Singapore?

What is TDSR

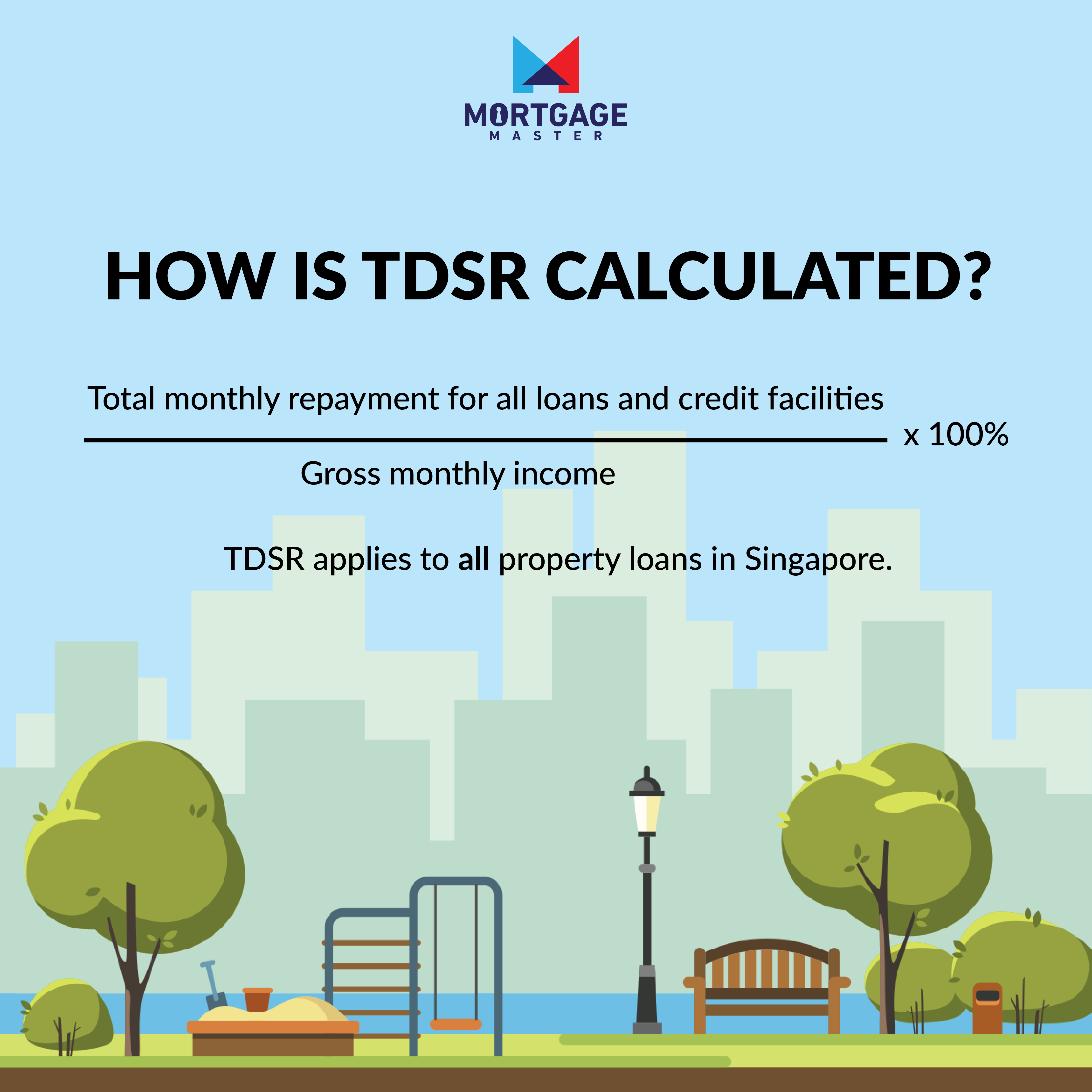

Total Debt Servicing Ratio or TDSR in Singapore is the proportion of all your monthly debt obligations to your gross monthly income.

As of 16 December 2021, thanks to the latest cooling measures, to obtain a loan in Singapore, your TDSR should be less than or equal to 55%.

Listen to Episode 20 on Apple Podcasts

Listen to Episode 20 on Anchor.fm

(Note: The Hows 2 House episode above was published on 20th Sept 2021 prior to the latest round of cooling measures. The maximum TDSR then was 60%.)

How to Calculate TDSR in Singapore

Very simply, take all your monthly debt obligations, divide by your gross monthly income, and multiply by 100%.

TDSR factors in all debt obligations, including the property loan you're applying for, credit card, car loans, student loans, and other secured or unsecured loans.

This is where it gets interesting: For credit cards, you look at the minimum monthly repayment amount.

In Singapore, this is $50 or 3% of your total outstanding balance, whichever is higher. If you have $1,000 outstanding on a single credit card, your monthly debt obligation for this credit card? $50.

However, assume you have $250 outstanding on each of four credit cards, your monthly debt obligations for credit cards? $200!

This is also why you should hold off on getting a larger ticket item like a car until you have secured your home loan. The more monthly debt obligations you have, the less you can borrow for your property.

TDSR Example

Let's assume your gross monthly income is $4,000. Based on current TDSR, your total monthly debt obligations cannot exceed 55% of $4,000 or $2,200.

If you have 4 credit cards, with $250 outstanding balance on each of them, your monthly debt obligations for credit cards is $200. Let's assume you also have a car loan, for which you're paying $1,000 each month.

$2,200 - $200 - $1,000 = $1,000!

That means your monthly repayment for your property cannot exceed $1,000! And because financial institutions must apply a "stress test" minimum interest rate of 4.0%, that means the maximum you can borrow for your property is around $200,000. That's not going to get you very far in the current property market in Singapore.

This is why it's so important to make sure you clear as many debt obligations as possible before applying for the property loan. And don't use so many credit cards!

Who is exempted from TDSR for property loans?

If you are refinancing a home loan for a property that you are staying in, financial institutions are not required to calculate your TDSR. Of course, you must still pass the financial institution’s other credit assessment criteria.

If you are planning to sell your existing property to buy a new one, then of course it wouldn't make sense to penalise you by limiting your ability to borrow. In such cases, you will need proof of your willingness to sell (for HDB flats) or a sale and purchase agreement (for private properties) to have your existing property loan exempted from TDSR calculations.

What about other exceptions to TDSR in Singapore?

At their discretion, financial institutions are allowed to grant property loans to borrowers despite exceeding the TDSR threshold. However, this is on a case-by-case basis and subject to enhanced credit evaluation, including reporting such cases directly to MAS.