Everyone scorns inflation. Who doesn’t hate the main factor that impacts our purchasing power and diminishes our quality of life? That’s why it’s important for us to recognise that the inflation that we are experiencing now is a timely reminder for us to start thinking about refinancing.

Why Is It A Good Time To Be Thinking About Refinancing?

The biggest pain about inflation is that it hits your disposable income directly. The higher the inflation, the more you will spend on your necessities. This results in lesser disposable income (i.e. less extra cash) for you to spend on other things. On top of that, let’s not forget that you still have your monthly debt obligations that you need to settle, particularly your home loan.

1. Strike The Best Deal With The Bank To Reduce Monthly Repayment

To get more bang for your buck, it is important for you to constantly be on the lookout for good deals. One place where you can potentially find good deals is from the home loan package from banks.

Sometimes, banks compete among each other to grab more market share in the home loan sector. And when they do that, they might be offering promotional deals. This is where you can benefit as a homeowner. You can sought to lower your monthly mortgage repayment to the bank on your home loan and potentially keep more cash with you as disposable income.

2. Extend Your Loan Tenure To Reduce Monthly Repayment

The Total Debt Servicing Ratio (TDSR) is a debt servicing framework that was introduced by Monetary Authority of Singapore (MAS) to help manage debt levels of households in Singapore.

Under TDSR framework, you cannot have more than 55% of your monthly income be used to service debt obligations. This includes home loan, car loan, and/or any personal loans. If you exceed 55%, any new loan that you would like to take up with have to take a haircut to the point where your monthly debt repayment is not more than 55% of your monthly income.

So, what does that have to do with refinancing? Switching from one home loan package to another is one common use case of refinancing. Another one is to do a cash out refinancing, which we will talk about later. But did you know that you can also use refinancing to extend the loan tenure on your existing home loan?

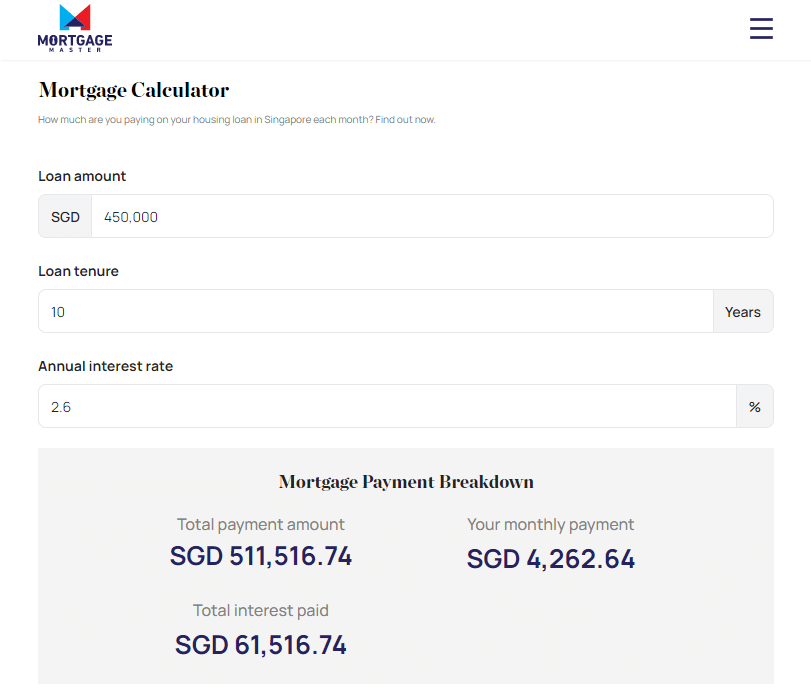

Let’s say you have $450k outstanding on your mortgage loan of 2.60%, with about 10 years remaining. You would be paying about $4,262.64 each month. That's no small amount!

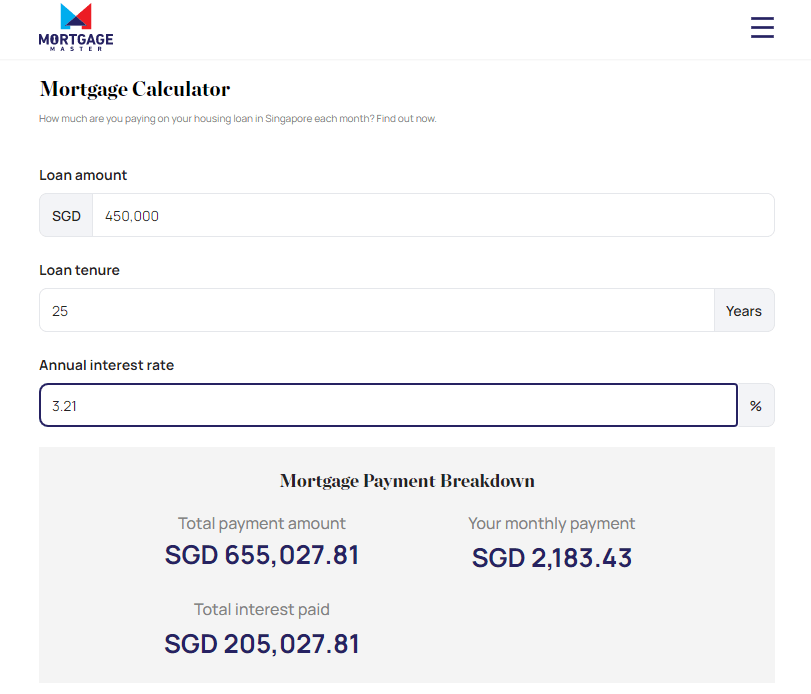

Should you choose to refinance, even with a higher interest rate, you may have the option to extend the loan tenure (depending on your age). If you extend the loan tenure to 25 years, this can significantly reduce your monthly repayment!

Doing this will practically halve your monthly repayment to $2,183.43 a month, and free up your monthly expenditure significantly to help you tide over the effects of inflation.

While you may initially scoff at the massive jump in total interest paid as the result of extending your loan tenure, remember that your priority is to ensure you have sufficient disposable income today. In two years' time, once inflation is reined in and you are able to manage a larger monthly repayment again, you can always refinance again and change the loan tenure should you want to.

3. Use Home Equity Loan/Cash Out Refinancing To Add More Cash Into Your Rainy Day Fund

You might have heard of this saying, “Singaporeans are asset rich, but cash poor”. Well, that’s quite true because a lot of us have majority of our assets tied to the primary residence that we are living in. However, because properties are considered to be illiquid assets, we do not have much cash on hand to spend.

One way to mitigate this is to rent out our home. For instance, we can rent out one room in the home to get some free cash flow every month. But this comes with its own set of challenges as well, especially for those who can’t stand living with strangers. Besides, you never know if you are going to be living with a weird tenant.

Plus, rental income is a slow way of getting cash from your property since it takes time to accumulate. What happens if you need a lump sum of cash? Fortunately, there are other ways you can raise cash so that you can deal with that pesky rising cost of living. A home equity loan (aka cash out refinancing) is one way to do that.

A home equity loan (or cash out refinancing) is where you pledge ownership in your property to the bank as collateral. In return, the bank gives you cash that is equivalent to the equity that you are pledging in your property. The amount you can borrow can be determined by this formula:

Property value – CPF – outstanding mortgage = Home equity

You will then be able to take a percentage out from this home equity, e.g. 80%, as the home equity loan. This helps to add more cash into your rainy day fund so that you don’t have to worry about not having enough cash to meet your personal needs. Thinking of getting a cash out financing? Hit it up with our mortgage consultants for more advice on how you can do this.

Need Help With Your Refinancing? Check In With Mortgage Master

At Mortgage Master, we know the latest home loan packages in the market and sometimes can even offer exclusive interest rate packages that you cannot get directly from the bank. If you're looking to purchase a new property, or refinance your existing home loan, fill up our enquiry form and our mortgage consultants will follow up with a call.